Hopefully, you’ll never have a medical emergency on a cruise ship while on vacation but accidents do happen. Normally you might assume that your health insurance or travel insurance will take care of the expenses. However, as one cruiser sadly found out, having a medical emergency can turn into a pricey ordeal if you don’t know the following information.

What Should You Do If You Have a Medical Emergency on a Cruise Ship?

First, all cruise lines have a medical facility onboard their cruise ships as well as a medical staff. The cruise ship medical centers can do things such as provide medications, perform minor surgeries, and even get you off the ship as soon as possible for more serious medical emergencies. Depending on the severity of the emergency, the cruise ship will either bring you to the hospital at the next port of call in for a helicopter evacuation.

Travel Insurance

First, it’s important to mention travel insurance, especially for those who are older and those who cruise frequently. As my in-laws just found out, not having travel insurance can be a critical mistake. Recently my in-laws had a fabulous Viking Ocean Cruise planned to South America. Unfortunately, my father-in-law has to get an emergency hip replacement and they are unable to go on their cruise. They have to forfeit 30% of their cruise, which may not sound like much, but for this type of cruise, it ended up being a $9,000 dollar loss.

Travel insurance will cover your loses for many things including medical emergencies on a cruise ship. It’s important to also take a look at your personal health insurance as many do not cover health related expenses if yu are over seas. This is why you may need a travel insurance plan.

Travel Credit Cards

Another option is to make sure you are paying with a credit card that has travel protection. For example, if you have a Chase Sapphire Reserved Card, they will reimburse your medical costs should you have an emergency.

upgradepoints.com

- Medical Evacuation Insurance — If you, or an eligible family member, become ill or injured when traveling, you could receive emergency transport coverage up to $100,000.

- Emergency Medical and Dental Benefit — Receive up to $2,500 for emergency treatment should you or an eligible family member become ill or injured when traveling 100 miles or more from home.

Though this credit card has a $550 yearly fee, it is actually cheaper than regular travel insurance and also comes with Priority Pass Lounge access, a $300 travel credit, Global & TSA Precheck reimbursements, and many more perks. This article has several other credit cards with travel protection.

Make Sure the Insurance Accepts Your Claim

You can be prepared with great insurance but here’s what they do not tell you. Unless you have the proper paperwork, they will reject your claim. This is crucial to know because trying to get the right paperwork once you’re off your cruise can be brutal or impossible.

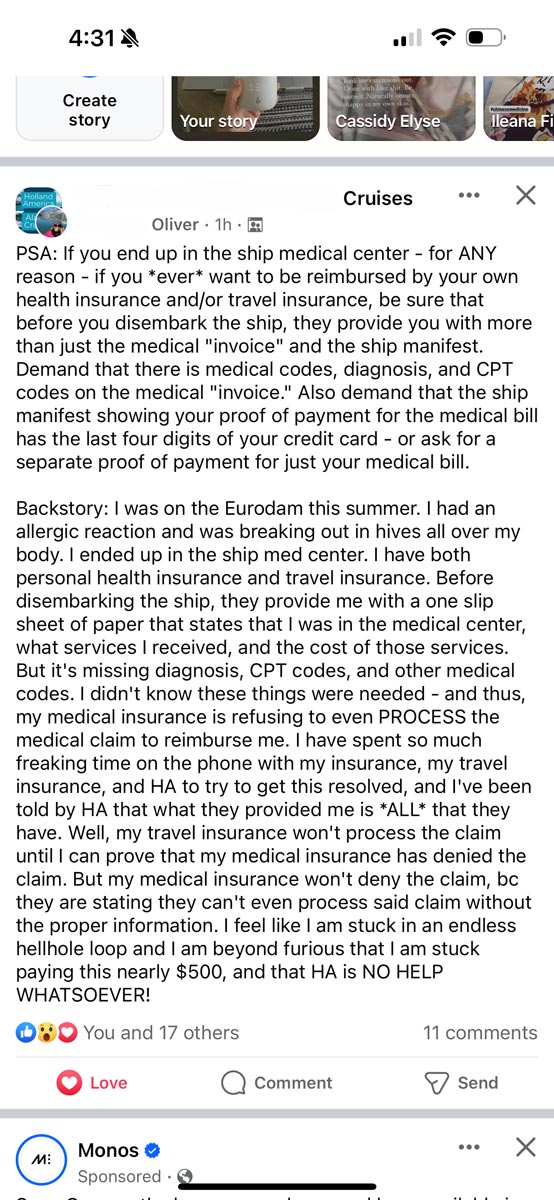

One cruiser found this out the hard way and shared her experience in a Facebook group. Ms. Oliver, a fellow cruise lover had an allergic reaction while on her cruise and broke out in hives over her entire body. She ended up in the ship’s medical center which resulted in a fee of $500.

While Ms. Oliver had both personal health insurance and travel insurance, her claims were both unable to be filed. According to both her personal and travel insurance companies, the one-page slip provided by the cruise ship for her medical care did not provide the required information to submit a claim. Here is what you need to know.

Medical Emergency on Cruise Ship Bill Requirements

Below is a list of requirements by insurance companies in order to submit a medical claim on a cruise ship. Trust me, you do not want to deal with this when you’re off the ship or you will likely be paying out of pocket. Make sure you take care of this before you get off the ship!

- Medical Codes

- Your official medical diagnosis

- CPT Codes

- Proof of payment that shows the last four digits of the card used for your medical payment. You can also ask for a separate proof of payment, making sure it shows your credit card information and what the payment was for.

Ms. Oliver received a simple slip that showed she visited the medical facilities on the ship, the service she received, and the cost. However, since it did not include any of the above information, her insurance companies are refusing to even submit a claim.

What Other Documents Do You Need to Submit

According to the Chase Reserve Card, here is a list of their required documents so you can have a better idea of what you might need to submit.

What Documents Will You Need to Provide?

The Benefit Administrator will provide the details, but generally You

should be prepared to send:https://static.chasecdn.com/content/services/structured-document/document.en.pdf/card/benefits-center/product-benefits-guide-pdf/BGC10981_SapphireReserve_VisaInfinite.pdf

- Completed and signed claim form

- Credit card statement (showing the last four (4) digits of the Account

number) reflecting the charge for the Common Carrier ticket (unless

the travel itinerary reflects the last four (4) digits of Your Account

number as payment method)- If more than one method of payment was used, please provide

documentation as to additional currency, voucher, rewards

programs or other payment method used- Statement from Your insurance carrier (and/or Your employer or

Your employer’s insurance carrier) showing any amounts they paid

towards the costs claimed- Copy of any other valid and collectible insurance or reimbursement

available to You, if applicable

o If You have no other applicable insurance or reimbursement,

please provide a statement to that effect- Receipts for eligible medical/dental expenses

- Any other documentation deemed necessary by the Benefit

Administrator to substantiate the claim

Better Safe Than Sorry

While not everyone might have this issue with a medical emergency on a cruise ship, I think it’s better to be safe than sorry. You just never know when a medical emergency can happen. Once you get off the cruise ship it can be nearly impossible to get issues resolved as Ms. Oliver found out.

In fact, if you have any issues, such as overcharges on your invoice, deal with it on the ship. Not when you get off. Always check your daily statements. In this case, it was just difficult for Ms. Oliver to know what she needed. I hope this article and Ms. Oliver’s experience can help fellow cruise travelers.

It also helps to read about the experiences of other cruisers who have had to deal with medical emergencies at the cruise ship’s medical center. On Cruise Critic, I found a thread for “Reimbursement for onboard medical expenses” which you may find helpful.

Sondra Barker

Sondra Barker